8 Ways to increase customer retention online using data and psychology

By Stephen Courtney|31 May 2022

Conversion Services | 7 MIN READ

Online businesses spend vast sums acquiring new customers but rarely invest in retaining them. Whilst loyalty apps are an increasingly popular solution, recent evidence suggests they may do more harm than good. To increase customer retention, you need tools that measure, analyse and influence behaviour.

The danger with any loyalty scheme is that it changes how customers think about their purchase/s. Poorly designed discounts can quickly undermine the value of a product and the perceived fairness of your pricing structure. Similarly, it’s easy to weaken customers’ long-term relationships with your brand by disrupting the operant cycle that perpetuates buying habits.

Stephen Courtney, CRO and UX Strategist

Without a plan for increasing customer retention, most of the money you spend on acquisition is wasted. However, traditional loyalty schemes based on points and discounts can produce unexpected “revenge effects”, reducing the value of your products and provoking customer “reactance”. To increase customer retention systematically and dependably, you need the right measurement plan, research methods and marketing strategies.

How to increase customer retention online

- What is customer retention, and why does it matter?

- How to measure customer retention

- The problem with loyalty

- 8 Ways to increase customer retention online

- Conclusion: How to increase customer retention

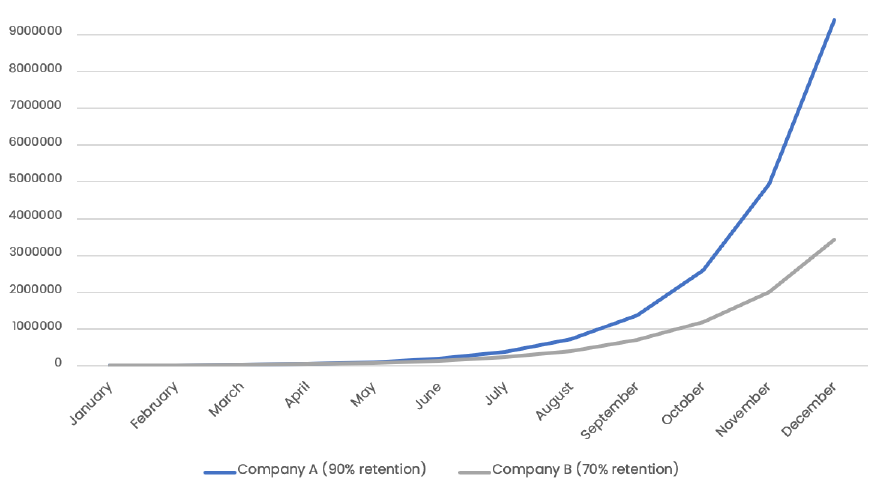

The following graph shows how the customer base for two hypothetical companies would grow over time. In both examples, the customers double each month, but Company B retains only 70% of the previous month’s acquisitions (compared to 90% for Company A).

What is customer retention, and why does it matter?

Customer retention measures the proportion of customers who continue to engage with your business after their first interaction. That might mean they return to make additional purchases or simply that they don’t cancel a subscription. In the same way that physical stores use packaging promotions and discounts to encourage return visits, digital businesses often use tools like loyalty apps to try and foster online habits.

Marketing experts used to believe that acquiring a new customer cost 5-25 times more than retaining an existing one. However, the cost of acquiring a customer through digital channels has increased dramatically in the past decade, so the financial benefits of retention are now even more significant.

Because it’s cheaper to retain customers than to acquire new ones, marketing strategies based on customer retention typically provide a higher ROI than an acquisition strategy. According to research by the business journalist Peter Drucker, companies with high Net Promoter Scores or satisfaction rankings grow 2.5 times faster than their competitors. That is partly due to reduced marketing costs, but it is also because returning customers tend to spend more.

However, despite the consistent growth in customer loyalty programmes, few businesses have found a reliable way to increase customer retention.

How to measure customer retention

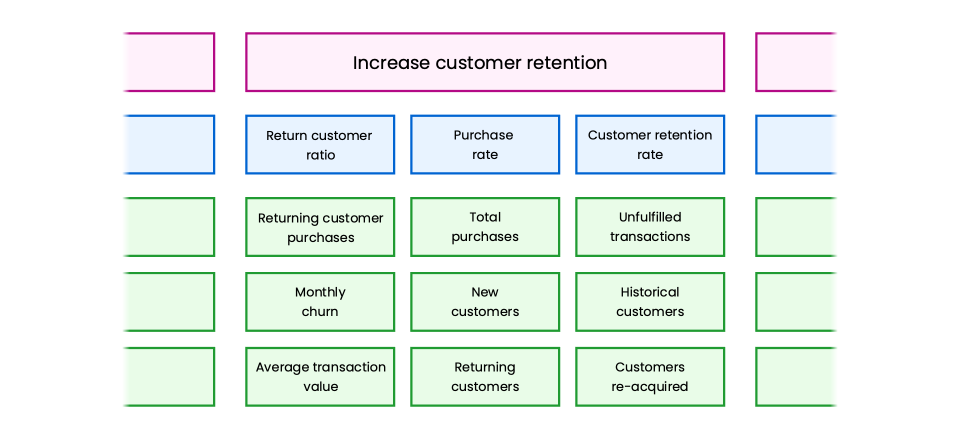

No single metric captures every aspect of customer retention. Instead, marketing teams build up a picture by combining different metrics and KPIs.

A quick way to analyse changes in customer retention is to measure returning customers on a month-by-month basis. To account for changes in your offering and your marketing mix, you should always view three numbers side by side:

- Return customer ratio

- Total returning customers

- Customer retention rate

Return customer ratio

Your return customer ratio is simply the proportion of your customers who have previously purchased. You calculate it by dividing your returning customers by your total customers:

((Total Customers – Acquired Customers) / Total Customers) X 100

Because the return customer ratio is strongly affected by the rate at which you acquire new users, it is used for internal monitoring rather than industry benchmarking.

Customer retention rate

Your customer retention rate is the proportion of your historical customers who return to make a purchase during a given period. Unlike your return customer ratio, your customer retention rate will vary considerably depending on the size of your existing customer database:

((Total Customers – Acquired Customers) / Historical Customers) X 100

For an online store with 10,000 previously registered customers, 5000 sales and 4000 newly acquired customers, the three KPIs would be:

- Return customer ratio: 20%

- Returning customers: 1000

- Customer retention rate: 10%

Measuring purchase frequency

When analysing customer retention over a more extended period, it can sometimes be more helpful to measure how many purchases a typical customer makes or how frequently they make a repeat purchase.

To calculate how many purchases a typical customer makes, you divide your transactions by your customers.

Monthly Purchase Rate = (Annual Purchases / Annual Customers) / 12

Since new marketing campaigns easily dilute this metric, it can be helpful to exclude single purchase customers from your calculations.

Creating a retention measurement plan

To track changes in customer retention, you need to monitor a collection of related KPIs. Combine these with other measures that tell you how different aspects of your marketing strategy are performing. A measurement framework can help you organise and interpret all of these signals and form the basis of your reporting dashboards.

The problem with loyalty

A well-engineered loyalty scheme can permanently change the way customers calculate costs and benefits. While Amazon loses billions of dollars through its Prime subscription service, the behavioural impact of Prime has transformed Amazon from an online store into a primary internet technology. Similarly, offline businesses have seen how digital loyalty programmes can hardwire consumer habits. In 2020, Starbucks’ loyalty app was responsible for 50% of the organisation’s revenue.

However, there is a downside to loyalty schemes. Research published in 2016 found a significant decrease in the number of purchases made by hotel customers who failed to reach the threshold for loyalty-based rewards, even when their bookings were otherwise unaffected. Likewise, more recent studies published in the Harvard Business Review have shown that loyal customers are more likely to complain about the quality of service when redeeming rewards than new customers.

The danger with any loyalty scheme is that it changes how customers think about their purchase/s. Poorly designed discounts can quickly undermine the value of a product and the perceived fairness of your pricing structure. Similarly, it’s easy to weaken customers’ long-term relationships with your brand by disrupting the operant cycle that perpetuates buying habits.

Building loyalty is not a simple case of 'rewarding' big spenders; you need to understand how your business fits into your customers' lives and engineer your service to foster persistent habits. That requires a box of specialist tools for analysing and influencing customer behaviour.

8 ways to increase customer retention online

Access to analytics and behavioural data means that digital marketers have everything they need to build persistent customer habits. These eight techniques can contribute clarity and insight to almost any retention strategy.

1. Customer journey mapping

The first step towards increasing retention is to understand how customers use your business. Customer journey mapping allows you to visualise each stage of the customer experience, opening them up for further analysis.

Your customer journey map should include an extra row that indicates the percentage of an average cohort that is likely to exit at each stage. Identifying the situations that prompt customers to leave will allow you to systematically reduce customer exits.

See our Ultimate Guide to Customer Journey Mapping

Use our guide to delve deeper into your visitors' motivations, attitudes, and behaviours to discover why potential patrons don't engage with your offering.

2. Cohort analysis

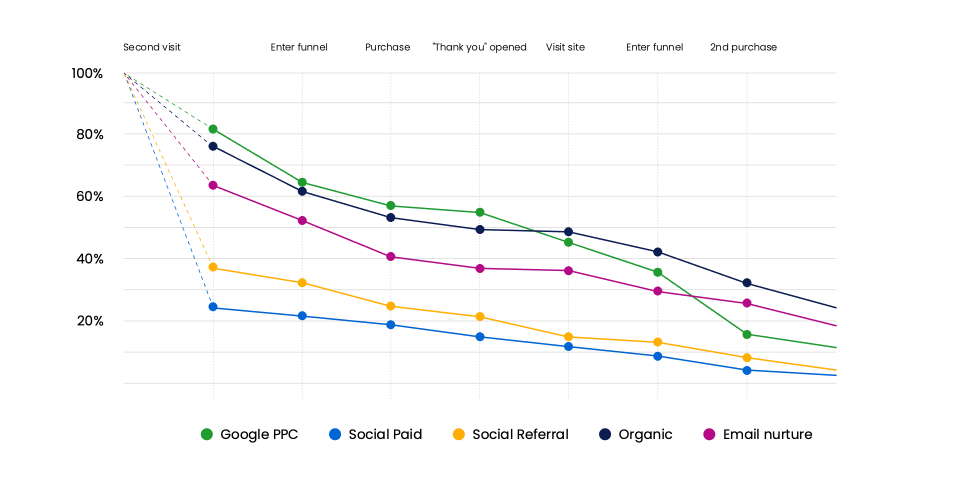

Cohort analysis involves grouping your customers into segments and plotting retention over time. The simplest way to segment your users is by sign-up date, but it is often more helpful to compare churn rate by acquisition channel or purchase type.

This kind of reporting is easiest if you have a well-engineered CDP (customer data platform) or integrate your CRM tool (such as Salesforce) with your Analytics.

3. Friction analysis

Friction occurs whenever your customers are uncomfortable or face an inconvenience that prevents them from taking action. For example:

- Removing steps from the customer journey (such as having to open and read a routine email because the subject line is unclear)

- Information gaps that mean a customer must trust you (for example, missing details about product returns)

- Learning curves and complicated processes

When friction occurs, customers will often revisit the cost/benefit calculation that made them choose you in the first place. Friction analysis is the process of systematically removing obstacles from the customer journey.

Friction is often hidden due to the “Curse of Knowledge”. Engineers, product designers and marketers struggle to anticipate the naturally occurring questions to first-time visitors. Because of this, user testing is an essential part of friction analysis. Similarly, conceptualisation techniques that bypass habitual modes of thought (such as “six hats” exercises) can help to reveal hidden obstacles.

4. Customer feedback channels

Maintaining popular customer feedback channels, such as NPS surveys, contact forms, live chat platforms, and exit surveys can provide priceless information. You can use this incoming data to enrich your customer journey maps and friction analysis, but it also gives you an early warning when there is a problem with your product or service.

There are other benefits to feedback channels, such as the opportunities it gives for validating the details in your customer database. Every time a customer responds with feedback, you can update their information.

Evidence from behavioural studies also suggests that customers who provide positive feedback will feel a strong impulse to maintain that position in subsequent responses (an effect known as “commitment and consistency”).1 Encouraging customers to confirm that they are happy with your service may help to improve the quality and consistency of your online reviews.

5. Disruptive interventions

Unusual and extreme incidents strongly influence memories. Daniel Kahneman’s experiments on the recollection of pain show how peak intensity, rather than overall degree, shapes the way people recall uncomfortable experiences. The same is true of a given episode’s final moments, which have a disproportionate influence over how the period as a whole is remembered.

Because disruptive moments colour your customers’ memories more vividly than routine experiences, unexpected interventions (for example, providing a spontaneous free upgrade) can help to offset occasional minor complaints. This technique relies on timing, so you should plan interventions using your friction analysis or customer journey map.

6. Personalisation

One of the best protections against churn is a high switching cost. When customers are encouraged to customise their profiles or accumulate social credit over time, they will be less inclined to abandon your service when they encounter a temporary inconvenience. SaaS businesses, for example, increase customer retention by encouraging users to invest time and effort in adjusting their settings.

Personalisation, in the form of curated recommendations or content feeds, increases the switching cost by adding value to your service over time. Similarly, retaining information from previous browsing sessions to pre-fill forms and anticipate user settings can make your website more convenient than any new competitors.

7. Create a re-engagement offer

If your CRM allows you to trigger workflows based on customer behaviour, you can increase customer retention by experimenting with re-engagement sequences. For example, a discount offer triggered after eight weeks with no interactions might help entice disengaged customers back to your website.

As with customer feedback channels, re-engagement offers have the added advantage of helping to improve data hygiene. Customers who are no longer interested in your business can be cleared from your subscribers to reduce the cost of maintaining that list.

As with disruptive interventions, the success of a re-engagement sequence depends on timing. It’s also important to remember that the most effective offer may not involve a financial incentive. Simply reminding a customer of previous purchases or introducing new product features might have a significant impact.

8. Customer loyalty programme

There are many different ways in which a loyalty programme might influence customer behaviour. For example:

- A discount can make your offers as competitive as possible for customers who have already covered the cost of acquisition.

- It can also leverage the Anchoring heuristic, making subsequent purchases seem like better value when compared to the original one.2 The impulse toward Commitment and Consistency will encourage first-time customers to repeat their initial choice.

- Gamification or status upgrades can help establish persistent habits by creating an operant feedback loop. Reinforcing the customer’s initial behaviour (their first purchase) can make the transaction a source of enjoyment.

The effect you hope to achieve with your loyalty scheme should help determine what kind of bonuses loyal customers receive and the schedule you use to distribute them. It’s essential to be precise with both aspects of your loyalty programme to avoid devaluing your offer or triggering customer reactance.

Conclusion: How to increase customer retention online

Calculating the true impact of retention strategies is exceptionally challenging. If your acquisition metrics remain stable, you can arrive at a rough value by multiplying the uplift in CLV (customer lifetime value) by the number of customers involved in your programme. The impact of your programme would then be found by subtracting the running costs of your programme from the revenue gained. However, the long time periods required to get a real sense of CLV make it impractical to measure accurately.

Instead, creating two segments and comparing a metric like annual purchase frequency would give you a more limited insight but more reliable data.

Sources

1 Robert Cialdini, John Cacioppo, Richard Bassett, Jacques-Alain Miller, “Low-ball Procedure for Producing Compliance: Commitment Then Cost”, Journal of Personality and Social Psychology 36 (1978), 463-476; Rosanna Guadagno, Robert Cialdini, “Preference for Consistency and Social Influence” Individual Differences and Social Influence 5 (2010), 152-163; Katie Baca-Motes, Amber Brown, Ayelet Gneezy, Elizabeth Keenan, Leif Nelson, “Commitment and Behaviour Change: Evidence from the Field”, Journal of Consumer Research 39 (2013), 1070-1084. Amos Tversky and Daniel Kahneman, “Judgement Under Uncertainty”, Science 185 (1974), 1124-31; Predrag Teovanovic, “Individual Differences in Anchoring Effect”, Europe’s Journal of Psychology 15 (2019), 8-24.

2 Amos Tversky and Daniel Kahneman, “Judgement Under Uncertainty”, Science 185 (1974), 1124-31; Predrag Teovanovic, “Individual Differences in Anchoring Effect”, Europe’s Journal of Psychology 15 (2019), 8-24.