How to understand your audience, customers and users

Understanding your audience, customers, and users is the key to winning big on effort vs outcome. Use this extensive guide to help you with this (often forgotten) crucial aspect of digital marketing.

It is essential for business growth and should be the beating heart of any marketing strategy. Knowing who you are reaching, who you want to reach (and who wants to reach you), and their intentions unfold the steps you can take to focus your marketing efforts on the right people.

While the COVID pandemic seems like a distant memory to some, it has left a lasting impact on the intentions and motivations of customers (and potential customers). From our years of experience, we always say that understanding your audience, users and customers is an ongoing journey rather than a one-time task; however, now it is more important than ever for organisations to reassess what they know.

This guide gives you all the information you need to understand your audience, customers, and users. We've included the why's, how's and when's. We also share what tools and methods you should use to collect data providing you with a platform to use the information to refine your marketing efforts and improve your bottom line.

Contents

- Terminology: Audience vs Users

- What is audience research?

- Why should you research your audience and users?

- The pros of understanding your audience

- Types of data: Quantitative vs Qualitative

- Popular research methods and the tools to use

- How to start researching your audience

- What to do with your research

- Summary / Key learnings

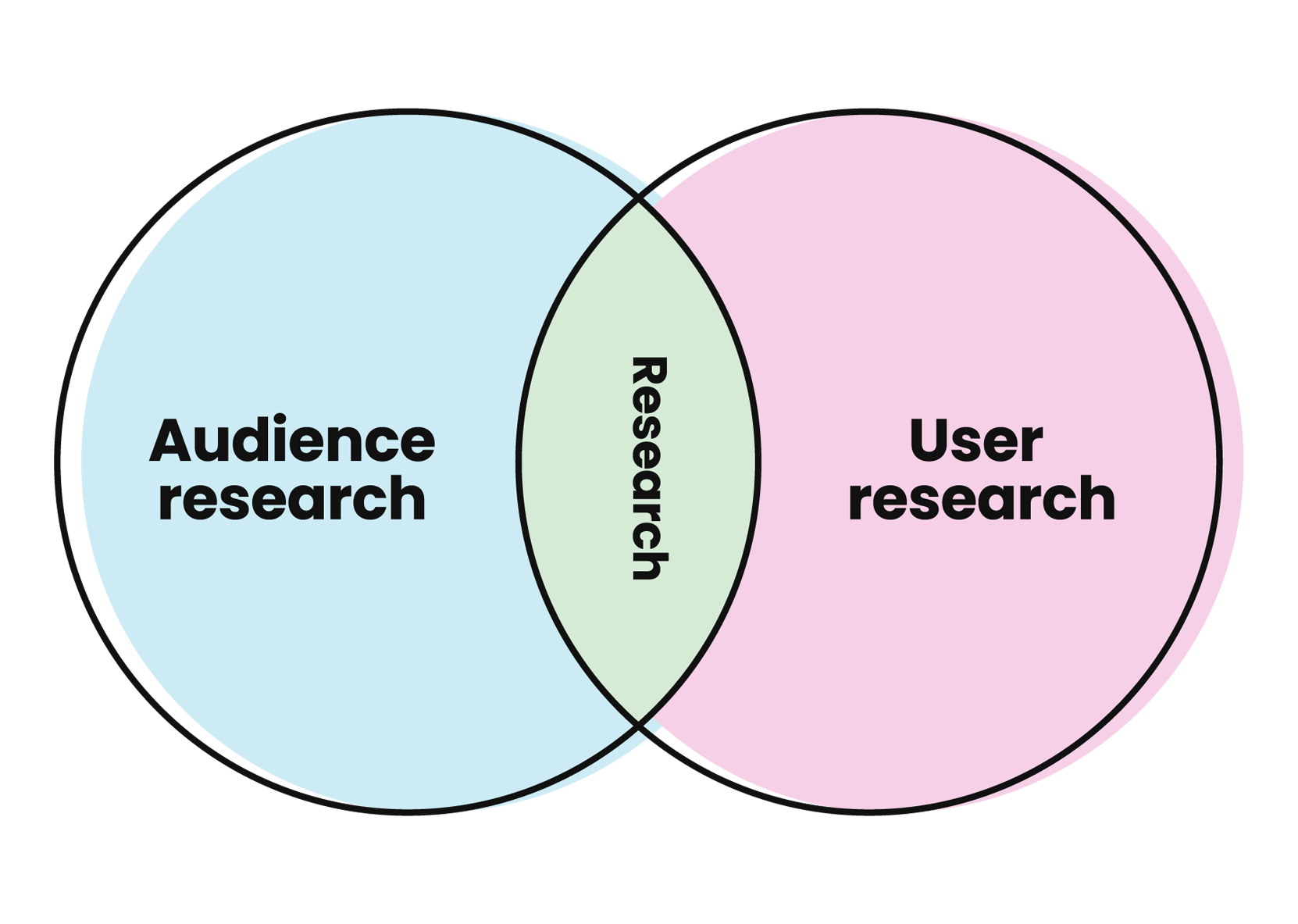

Terminology: Audience research vs User research

Audiences and users are often one and the same. While there is a lot of crossover between audience and user research, there can be subtle differences between the two.

User research

The application of user research focuses on those who are already using or would potentially use your website or app. It aims to provide insight into the overall user experience, as well as discovering the needs and motivations of your users.

Audience research

Audience research is where you need to start before any marketing activity. The term 'audience research' is more extensive. It encompasses people who have never encountered your brand or product, those you want to target, and existing users (or customers).

Where does 'customer research' fit?

Then there is 'customer research', which many believe (and is considered) interchangeable with 'audience research'.

There are instances where both user and audience research apply. In these instances, we will use the term 'research' to keep the distinction as straightforward as possible.

What is audience research?

Audience research tackles the broad question areas and gives you an idea of the bigger picture. This research tactic helps your organisation deliver against your company, marketing, or campaign objectives. It gives marketers an understanding of who you are (and should be) ‘talking’ to. We recommend that it take place before other research forms, such as in-depth customer journey mapping.

Some of the pertinent aspects you may wish to look at within your research include:

- Size of audience

- Composition and characteristics

- What interests them?

- Who influences them?

- What are their needs?

- What problems do they have?

- What do they think of existing products?

- How they feel about branding, reputation, and service

- What is their experience like?

💡 Top Tip!

We recommend having a basic customer journey to reference as you start your audience research. The output can help you focus on where to perform that research, e.g., keeping customers loyal and getting new customers (including looking at other companies too).

Why should you research your audience and users?

Your audience encompasses a vast range of people. By understanding who they are, their wants, needs and intentions, you can discover those you need to target. Once known, you can segment them and market to them more effectively, saving time and valuable resources.

Three learnings that come from audience research:

- Audience understanding

Understand your audience to result in more effective targeting, which benefits your wider organisation. - Decision making

Make decisions by looking at the facts rather than assumptions. By doing research, you can confirm or dismiss stakeholder prejudice. - Test hypothesis

Audience research is an excellent way of testing theories and hunches (remember, 'stakeholder prejudice') to provide the data you need.

The pros of understanding your audience

We have been helping our customers with audience research for years. If done correctly, it has excellent effects on your marketing efforts and the wider business.

Our audience research project with the Health Foundation is a prime example of how organisations can gain valuable audience insights through research done well.

Working together through different research types, including quantitative analysis and qualitative audience interviews, we future-proofed their audience understanding. Work included:

- Designing a roadmap of marketing and communications to implement and test.

- Equipping their team with the knowledge and tools they need to ensure an audience-focused approach to their future activities.

- Opening the doors to further training and maximising value from data through quantitative analysis of their Google Analytics setup.

Understanding audience journeys for the Health Foundation

See how we assisted the Health Foundation in understanding their audiences better to help them drive engagement across their communications and marketing channels.

The pros for your marketing activity

Identify obstacles, sometimes at an early point (e.g., before you launch something) – early feedback from an audience or user group can give you an idea of what (if anything) could be an obstacle for your business when doing something new. You can also target the activity better.

Anticipate future needs – speaking to your audience about their plans and ideas can assist in anticipating and adapting to their future needs.

Ensure activity has the best chance of success – basing your work on facts gives it the best chance of doing well.

Better targeting for activity (e.g., learn more about which digital platforms are relevant to your customers) – for example, TikTok is now the platform of choice for millions of people. However, is that where your audience is? If so, would they click through to your site, or are they using the platform purely for some light-hearted relief?

Attract more customers/new customers and improve sales/conversions in the long term – by embedding audience research in everything and putting the user first, you drive that growth for your business.

For the wider business

Helps to validate organisational assumptions – often, assumptive ideas are put forward within a business. Audience research is the perfect mechanism to validate or challenge them.

Provides internal stakeholders with 'the truth' – involving stakeholders at an early stage creates the platform to gain transparency of assumptions providing an opportunity to test them.

Makes sure you have the customer truly front-and-centre – being customer or audience-focused starts with understanding who the customer (or potential customer) is.

Saves time and money – more effective marketing results in spending less time, effort and money on reaching out to the wrong people.

Significant effect on the business as a whole – although the key takeaways for the marketing team may be a little more obvious, there is something to be said about its impact on your wider business. For example, for a recent client, we discovered that their audience was keen to have easy access to the business from a tube station and often based their buying decisions on whether they could get to the company in question. This finding resulted in the senior team having informed knowledge to improve decision-making regarding choosing physical locations.

Complete the puzzle – you can learn from existing data. However, doing research can fill any gaps you have. Gap filling provides a better understanding and overview of the end-to-end customer journey.

It gives you the ability to make more confident decisions – with a better understanding of what people want (and need), you can make better-informed decisions to benefit your business.

💡 Top Tip!

Each time you undertake audience research, you learn something new that improves user experience and benefits the business.

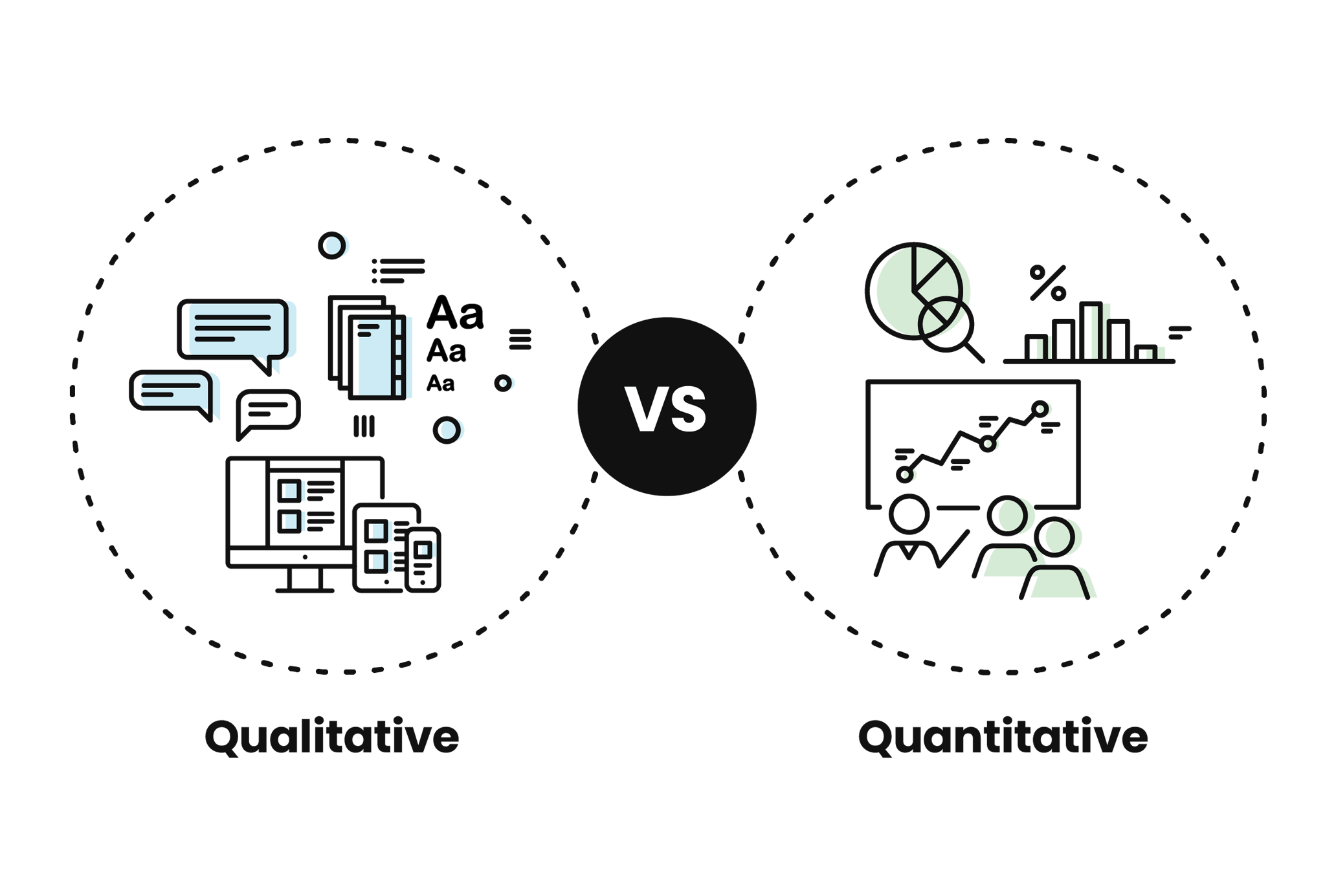

Types of data: Quantitative vs Qualitative

There are typically two types of data obtained through audience research; quantitative and qualitative. One is numbers-based, and the other is more descriptive. It's relatively simple to remember them through their names:

- Quantitative derives from the word 'quantity', meaning an amount or measurable.

- Qualitative derives from the Latin word 'qualitas', meaning 'quality' - therefore, it is about the quality, not the quantity.

Quantitative

Quantitative data can be counted, measured and expressed using numbers.

You can generate the findings through:

- Website metrics

- Surveys (closed questions such as 'yes/no' or numerical scales)

- Tests and experiments

Qualitative:

Data that is descriptive, conceptual and non-statistical.

You can collect qualitative information through:

- Interviews and focus groups

- Observations

- Audio and video recordings

- Texts and documents

Both types of data help us to understand the fuller picture. Quantitative data gives us the 'what'. It shows us what people are doing. Qualitative data gives us the 'why' as we get more feedback style data through asking questions and interacting.

Can you perform effective audience research with one quantitative/qualitative data set only?

Many research studies will often use either quantitative or qualitative data because one suits the thing you're trying to test or the question you want to answer better. For example, if you want to understand the "why" in a situation, you might be better off using qualitative data.

Should you combine qualitative and quantitative data?

Combining the two is not uncommon. A word of caution - make sure you sense-check that mixing them will not confuse the results in some way or lead you to draw the wrong conclusions.

What information do you need to understand about your audience?

Critical knowledge to harvest includes goals, bounce rate, conversion rate, and spending power. You can ask the following questions, for example:

- What is happening in the customer and user journey

- Where are people dropping out?

- Does the audience like your message? Is it clear?

- How do they feel about your brand?

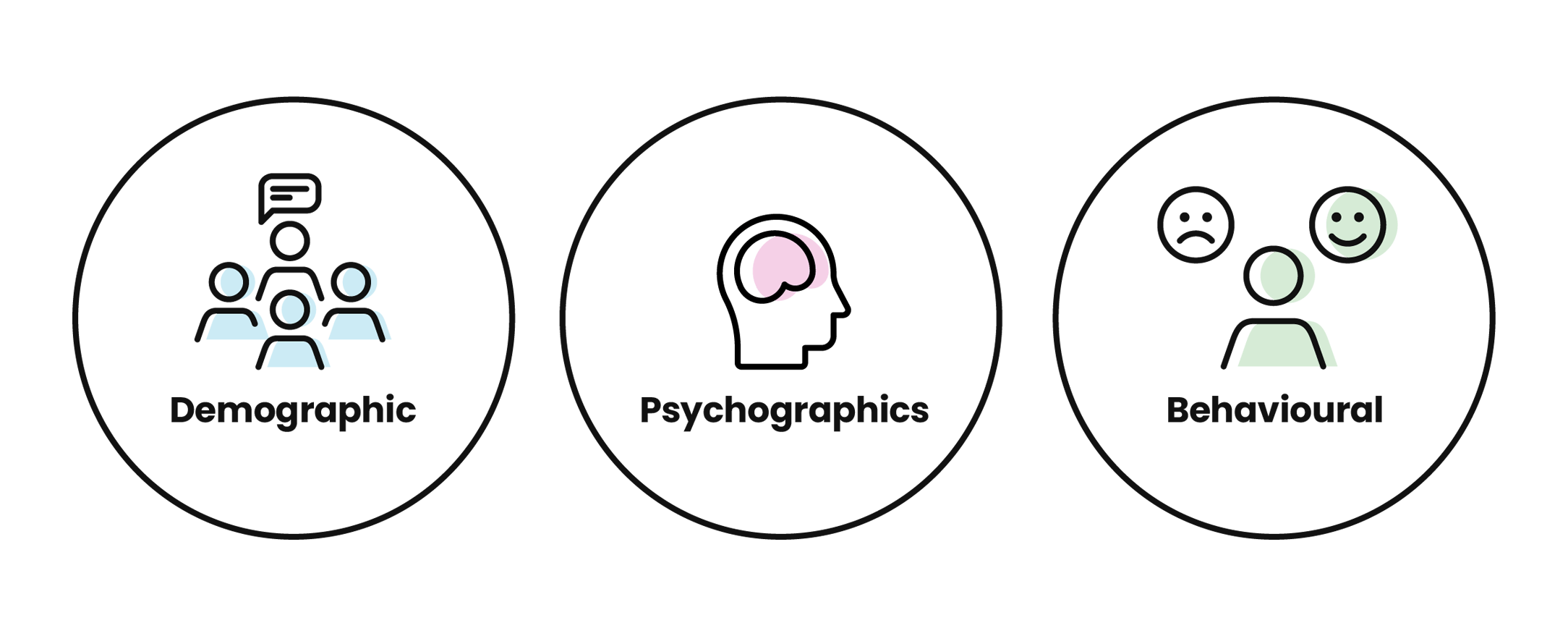

You can then break the results into three separate areas, each of which can then be segmented.

Demographics

Demographics are typically statistical data sets that characterise a particular group of people (such as a persona or audience group).

Demographic factors:

Typical factors to be collected and analysed include:

- Age

- Gender

- Ethnicity

- Location

- Education

- Occupation

- Income and family structure

The information provides more factual data on who and where people are.

Example data sources:

- CRM/database

- Website analytics (e.g., the Google Analytics 'Demographics and interests' report)

- Social media (Facebook, Instagram, TikTok, Twitter, LinkedIn)

- Customer surveys

Psychographics

Psychographics is the study of customers relating to their beliefs, opinions and life goals. These can be connected to culture, religion, socioeconomics, or other social groups.

Psychographic factors include:

- Values

- Interests

- Opinions

- Attitudes

- Goals

- Motivations

- Needs

Example data sources

- Social media

- Website analytics are browsing data

- Customer surveys and questionnaires

- Interviews

- Focus groups

- Brand awareness and preference surveys

Collecting this information is both valuable and helpful. It curates an idea of your audience and users' needs, wants, and goals. To obtain it, speak to them in interviews and focus groups. This way, you can listen to what they are saying, get a feeling for their genuine feelings and dig down into people's values, attitudes, and beliefs.

Behavioural

Behavioural data is how people act or behave when attempting to do something in a digital setting. The information gathered will typically reveal how users engage with your product or service, website, app or across a whole journey.

Behavioural factors include:

- Search intent

- Website visits

- On-site or on-page engagement

- Content engagement

- Product usage

- Consumer paths (including conversion)

- Device usage

The information gathered tells us more about what people are doing, their actions, and what they are looking for. Comparing this to the psychographic factors is interesting as there is often a difference between what people say and what they do.

Example data sources

- Website analytics

- Search data (Google Search Console/Google Analytics)

- AdWords and Bing Ads data

- Call centres/customer support queries

- Heatmapping

- Eye-tracking/facial expression tracking

- Product/service reviews and feedback

Tools to help you understand audiences

So now we have an understanding of what information we want to obtain, we can look at which tools you can use to complete your research and what you get from each of them.

Primary vs secondary research

When it comes to tools to help you gather knowledge of an audience, it helps to understand the difference between primary and secondary research.

Primary research is information gathered through fact-finding tactics that you conduct yourself. Research types include surveys, interviews, observations, data analysis and focus groups. The data is collected and obtained 'first-hand'.

| Advantages | Disadvantages |

|

|

Secondary research is information gathered from previously conducted research studies. Examples include published books and articles, commercial information sources, government agencies, educational institutions and academic peer-viewed journals.

| Advantages | Disadvantages |

|

|

Whether you choose to do primary or secondary research, and in which order, depends on your needs. Typically, secondary research is done first, followed up with primary research. This way, secondary research gives you the bigger picture, and you can follow it up with primary research to plug the gaps or delve deeper. In this guide, we will focus on primary research.

Conducting User Research with older people

Learn why if you are building a website for children, adults, or the whole family, we think it is essential to gain a deeper understanding of the older audience and design with them in mind.

Popular research methods and the tools to use

There are many ways to perform primary research to help understand your audiences and users.

We've picked out those we have seen the best outcomes from and outlined them below, with the pros and cons and the tools to use (where relevant).

1. Interviews

What it is: Direct interaction with a respondent, often via phone, video call or face-to-face. Typically, interviews use open-ended questions to uncover a wide range of insights – motivations, beliefs, experiences, journeys and ideas.

Data type: Qualitative

| Advantages | Disadvantages |

|

|

Tools: The key to interviews is to ask the right questions correctly. It is easy to lead your audience, especially if you are doing them for your organisation. If you are worried about bias, we recommend working with an independent agency to design the questions and perform the research. Involving a third party ensures no bias or leading and will deliver more accurate results.

2. Surveys

What it is: A set of questions posed to a sample group of customers – often run online or sent directly via email.

Data type: Quantitative and qualitative (question dependent)

| Advantages | Disadvantages |

|

|

3. Focus groups

What it is: Research carried out with a small group (often 8 to 10 people involving discussions centred around a brand, product, idea or concept. This is typically led by a moderator who keeps the conversations flowing, with others observing to take notes.

Data type: Qualitative

| Advantages | Disadvantages |

|

|

Tools: The most important people in group situations are your moderator and observers. Keeping the conversation flowing and on the topic is essential, as is gaining the correct information from observations. These work best if the group has a common interest. Be mindful that some people may be reserved with a group of strangers.

4. Observations

What it is: Indirect research method whereby the researcher watches what the participant does and observes (and takes notes) on their activity. The researcher can conduct the offline (e.g., in-store) or online (e.g., observing transaction behaviour) with heat mapping or screen recording tools.

Data type: Quantitative and qualitative

| Advantages | Disadvantages |

|

|

Tools: Online - heat mapping tools such as Hotjar, Crazy Egg, Zoho PageSense, and Contentsquare are effective. Offline - the tools required include recording software and a note-taker.

5. Quantitative data analysis – e.g., website analytics

What it is: This involves collecting data from people engaging with your website.

Data type: Quantitative

| Advantages | Disadvantages |

|

|

Tools: Google Analytics, Adobe Analytics

6. Competitor Analysis

What it is: This typically involves using online tools to see what your competitors are doing and who they are communicating with. Checking who ranks for specific keywords is an excellent way to find competitors. You can use social media monitoring tools to see how they communicate, what is effective for them and who they are reaching. It is also good to sign up for their email newsletters. Although we cannot see their effectiveness (click-throughs etc.), you can get a more detailed picture of their marketing strategy.

Data type: Quantitative

| Advantages | Disadvantages |

|

|

Tools: Social media monitoring tools such as Hootsuite, Brandwatch, Brand24, YouScan and AccuRanker. You’ll also need some analytics tools; Google Analytics, Adobe Analytics and Google search console.

Other popular research methods include:

- Customer feedback reviews

- Polls

- Customer panels

Choosing the correct research method is one of the most exciting and potentially challenging parts of researching your audience and users. Please read our article on how to use the right research method for some more inspiration and help.

💡 Top Tip!

Combining different research methods within the same audience research project can maximise your learnings, leading to a better understanding of your audiences and users.

How to start researching your audience

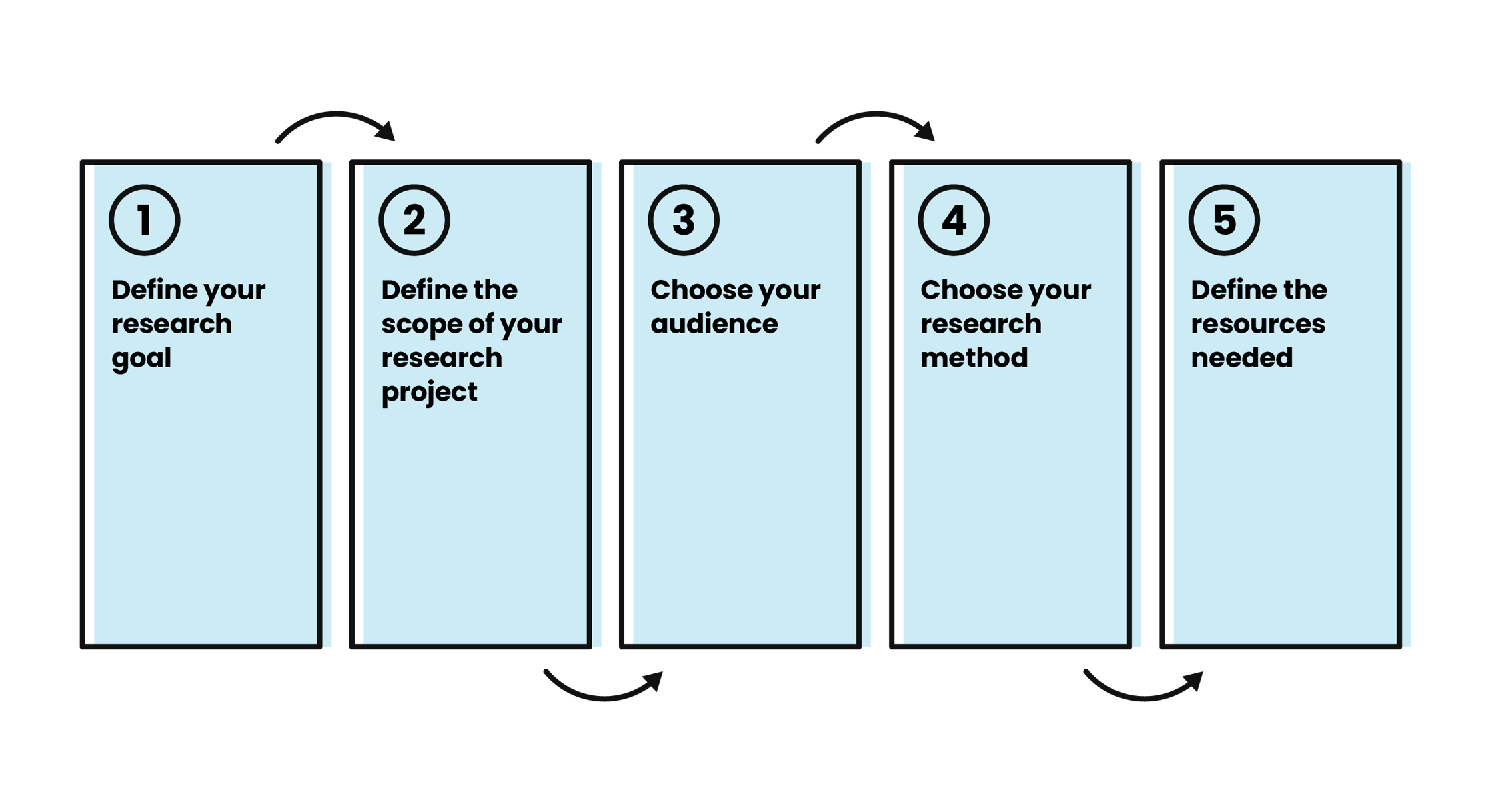

Before you start to research your audience, users and customers, you need to know what you want your research outputs to be. What information do you need to obtain, and how do you want to have it collated?

You need to prepare five things before you embark on your research project.

- Define your research goal

- Define the scope of your research project

- Choose your audience

- Choose the research method(s)

- Define the resources needed

- Create a brief

1. Define your research goal

Before starting your research, you need an objective – what are the primary questions you want to answer? Where possible, align this with one or more of your business goals. Get the goal aligned and written down so everyone is on the same page. From there, you can start to plan out the next stages.

For example:

A charity engaged us to research to help feed into a website redevelopment. The question they wanted to answer was:

"What role does our website play for our key audience groups?"

This research gave us an idea of the questions, methods and outputs we need to consider.

Other use case questions could include:

"What is the current experience like for our customers (and potential customers) across all stages of the journey?"

"What is the crossover between online and offline touchpoints for our customers during the research and decision-making stages?"

2. Define the scope of your research project

To get a solid plan in place, you must consider factors such as time, budget and skills. Do you have the time and skills in-house? Do you have any deadlines? Can you be objective with your products or service, or should you outsource to get less bias in your data? By digging into this, you can discover whether you have the skills and capacity to do this within your business.

3. Choose your audience

To understand your audience, you need to start somewhere. Do you want to look at your current customers or discover prospects? Organising a wide range of research, especially where interviews or focus groups are required, takes planning. Start earlier than you think.

If it is an existing product, consider engaging with your current customers. If it’s a new product, do some broader market research to discover what that market is like for your specific product. Find the online spaces where your potential customers are and look at online conversations. You could also start by looking at search terms and results.

4. Choose the research method(s)

What data are you looking to obtain? You must choose the appropriate method(s) to harvest the required data within your timeframe and budget.

5. Define the resources needed

Before starting your research, you must look at the practical side of things. Do you have the proper access, time and team to conduct the research?

Think about:

- Tools – heat mapping, survey software, tagging insights – a vast range of tools are available. Does your organisation need to invest in new tools? Is there a budget available?

- How to – if you're doing the research yourself, are you up to date with the latest research best practices?

- People – can you assemble an effective team within your timeframe? Do you need external support?

- Practicalities – what software do you need? Do you need a venue? Have you got the correct legal consent in place?

6. Create a brief

Once you have the above five steps in place, create a research brief. The brief will bring your team together and align them to the plan. The output can be a simple spreadsheet or a printout with sticky notes. Pulled together in one document, you'll have the outline of your aims, tools and any potential hiccups together. Make it clear and easy to understand, and ensure sure you include the following:

- Your project outline – include a name and an overview

- Roles and responsibilities – who is doing what within the project

- Background – what are you researching, and what are the goals of the project

- Research details – methods to be used, number of participants

- Research considerations – risks, challenges and scope

For some inspiration, please have a look at our research brief template.

Read our guide about choosing the right user testing method

Watching users undertake tasks allows businesses to find out where their audiences may be experiencing confusion and any difficulties they are having. Findings from user testing give clear direction for design changes or A/B tests.

What to do with your research

Having spent considerable time, money and effort on research, you must make the most of it. There are two sides to what you should do with your research, which we separate as internal and external.

Internal: education and communication within your business

- Package it up for internal stakeholders and share it widely across the business.

- Offer to present it to relevant people within the organisation – get everyone on board with who your audience is

- Create visual resources for internal staff, for example, customer journey maps

- Save it somewhere easily accessible for the entire business so it can be accessed and reviewed frequently (they may need a nudge)

- Create a research repository to house all your insights in one place for reference. Make sure you tag your content for ease of reference. Software such as Miro Board can be a great way of keeping it all together while providing a clear, visual, easy-to-understand representation.

External: extending the value into marketing

- Prioritise all subsequent recommendations and ideas - to help, look at 'impact vs effort'.

- Ensure you feed insights and recommendations into future planning sessions. Your research will give you a better understanding of your audiences and users. Remember to include the findings with all your marketing strategies. Look at your overall business strategy and channels, such as email marketing, paid search, SEO, etc.

- Arrange brainstorming sessions – this is your chance to develop opportunities into ideas with the team.

- Consider sharing a version with your audiences - this helps show them you are being transparent, that you have been listening, and are open to feedback.

Maintaining your audience research

Audience research is an ongoing, continual journey. Constant changes in technology, the economy and the environment result in the ever-changing audience and user needs. On top of that, more seismic global issues, such as the Covid-19 pandemic, will have a huge, long-lasting impact.

We recommend having an audience research programme if you have a customer-focused business because:

- No single piece of research can give you all the insights you need about your audience, users and customers.

- You can stay on top of situations impacting your customers (e.g., a pandemic, political event, social or technological change)

- It is the best way to validate or challenge internal opinions and assumptions from stakeholders and yourself.

Our top tips on establishing your programme:

- Make sure to integrate it with your overall business and marketing strategy.

- Use it across your digital services and integrate them for joint research (e.g., SEO, Paid Search and UX)

- Work out what you need to learn more about and when and from whom you want to learn it. You may decide to do one large research project per year, supplemented by smaller pieces to fill the gaps.

- Create some audience research groups or panels. Ensure you monitor these to help eliminate bias.

- Set out key points in the year or within your processes where research is applicable (e.g., as part of your budget or strategic planning)

- Establish some ways of collecting audience insights quickly and regularly. Good examples include a quick customer satisfaction survey on your website or a customer care team periodically reporting on key feedback points.

Summary / Key learnings

Understanding your audience is key to:

- Saving time, money and resources – time is valuable, don’t waste it on marketing to the wrong people.

- Staying customer-focused - have a customer-focused organisation that focuses on the customer.

- Making decisions – audience research data validates or challenges stakeholder prejudice for a clearer path for your organisation.

To understand your audience, you must:

- Conduct audience research – do this regularly as motivations and needs are ever-changing.

- Design an audience research programme – this ensures you stay on top of your research.

To conduct successful audience research, you must: - Focus on what you want from the research – what questions do you want to answer, and what will you do with your findings?

- Follow the research process – consider objectives, audience, methods and resources. Pull this into a research brief.

To make the most out of your research, you must:

- Keep using it, sharing it and referring to it.

- Eat, sleep, research, repeat – ensure your audience research programme (referred to above) contains plans to continue research and get your organisation excited about it.

Ultimately, understanding your audience, users and customers should be at the heart of your organisation. It keeps you customer-focused, in touch with social changes and challenges stakeholder prejudice. Effectively, it gives you the tools to increase value, productivity and, ultimately, your bottom line.

No matter where you are on your journey to understanding your audience, you can get in touch with us for advice and support. With years of experience, we can help you with where to start, your next steps, or even outline your ongoing research programme so you can make the most out of your research and keep your organisation focused on your customers.

Loading

Talk to us about learning about your audience

Tell us your needs and we'll be in touch

Do you have a challenge we can help with?

Let's have a chat about it! Call us on 01903 337 580